Global Perspectives

The World in 2022 – Key trends for International Finance Centres

If recent experience has taught us anything, speculating about the future in an uncertain world is a complicated task. Despite this, back in December 2020, we picked out some key themes that we thought would shape 2021.

As the year draws to a close, we reflect on which of our 2021 themes will continue to feature in 2022 and the new emerging issues that will join them.

1. The Biden presidency

We predicted; the Biden Presidency would focus on US domestic policy, a return to multilateralism, and reframing the relationship with the WTO, the EU, and China.

Most of these things have come to pass, and we believe that US politics will continue to have substantial implications for the global economy and International Finance Centres (IFCs) in 2022.

At home, the US has seen substantial tax rises, increased infrastructure and welfare spending, and calls for the wealthy to shoulder a more significant proportion of the "Build Back Better" burden. The intractable Democrat-Republican battle continues with mid-term elections in 2022. A slim Democrat majority already looks fragile.

A challenging vaccine roll-out, price boosting supply chain problems, and $2.8trn of additional spending has seen inflation climb to 30-year highs. As former Treasury Secretary and Economist Larry Summers said, "a society where inflation is accelerating feels like a society that is out of control".

Efforts to build a western coalition of liberal democracies to face China as a collective gained only modest traction, and COP26 produced words of intent but not much new by way of immediate action. In contrast to the troubled exit from Afghanistan, the Global Tax Accord sponsored by US Treasury secretary Janet Yellen signalled a foreign policy success.

Whilst it may be overheating, the US economy continues to be the global barometer for economic activity. The US reputation as the 'Start Up' nation with free-wheeling markets fulsome with innovation and enterprise remains intact. A globally significant importer and exporter of investment capital, the US will be critically important to International Finance Centres (IFCs) in 2022 and beyond.

.jpg)

2. The G2.5

We predicted; Positivity around the potential of international trade, continuing East-West tensions, and a more consensual US-EU dialogue.

G2.0 refers to the US and China, the two dominant powers competing for global influence and control whilst increasingly challenging each other's ideological systems. The EU (.5), are not as powerful or significant and in contrast, exert their influence principally through trade and regulation.

In 2021, trade rebounded from its pandemic lows, but supply chains have evolved as we predicted. With Samsung's announcement of a $17bn chip plant in Texas, regional is the new norm.

Getting Germany's primary natural gas pipeline project, Nordstream2, over the line seems to have lessened US-EU tensions, as has the resolution of the dispute over the taxation of the digital economy. But the relationship between the US Eagle and the Chinese Dragon is strained, with limited dialogue between the two great powers.

Issues such as Taiwan, intellectual property and trade tariffs will persist in 2022, while the deployment of hypersonic missile testing by China is a Sputnik moment for the US military. The American administration will closely monitor the build-up of the Chinese nuclear arsenal.

In Europe a new German coalition government and a French Presidential election will lean into an internal focus concentrated on the EU pandemic recovery efforts.

In China, the zero covid policy, travel bans, and troublesome trade relations with the US and EU could see lower growth at a sensitive time for domestic politics, with the five-yearly gathering of the Chinese Communist Party Congress taking place.

And, of course, there will be the US mid-term elections already referenced.

All countries will be keen to see a robust economic recovery from the pandemic, and high levels of investment will be encouraged and beneficial for IFCs.

3. Beating Covid

We predicted: A restoration of some sense of normality after extensive lockdowns and a quiet return of consumer and investor confidence.

More progress than expected was seen and exceeded our expectations. Many developed countries have high vaccination rates and are making progress with booster programmes. Developing countries are further behind, with the World Health (WHO) calling for increased support and financial assistance where needed. Working from home (WFH) has progressed to a hybrid model of WFH and working from physical locations with attendant benefits.

The emergence of new variants remains the most significant risk to the pandemic recovery, with Omicron the latest evolution in the virus. Covid will continue to have a massive impact in 2022 and into 2023, given the logistical challenges of the global vaccination programme. Its long-term effects on public health standards and regulation will be profound and the impact on public finances far-reaching.

.jpg)

4. The Great Reset

We predicted: An exciting and rapid pace of innovation, a drive to address social inequalities and a sharper focus on climate change and sustainability.

In 2021 the world vaulted forward in digital adoption by more than five years due to the pandemic. It seems probable that much of that digital progress will become embedded.

In 2022 we expect this trend to accelerate, with increased access to a widening range of services, particularly health via digital means, and a massive focus on sustainability and climate change. Firms will be required to name their net-zero target date, and the investor community will demand greater transparency and disclosure around sustainability credentials and impact investments. The prioritisation of diversity and inclusion will be a given, leading to measurable progress.

5. The Great Debt Experiment

We predicted that: Economic stimulus measures were likely to see public and personal debt levels go even higher, and managing private and public budgets back to sustainable levels will continue to be a significant challenge.

Global debt continued to climb in the first half of 2021 but declined slightly to $296 trillion in Q3, helped by more vigorous economic activity and higher inflation in developed markets. Debt is still near all-time highs at over $30,000 for each of the 7.7bn people in the world today. At more than 3 X global annual output, the resilience of the world financial system and its ability to withstand further shocks is in doubt.

Many commentators believe overstretched public finances will require adjustments to public spending and that tax rises are inevitable. Central banks will have to walk a tightrope in the coming year faced with the prospect of tackling inflation through interest rate rises, but adding to the debt servicing burden of households and Governments.

.jpg)

6. Private Capital

We predicted that: There would be increased demand for private capital to play a role in economic recovery, and new public-private partnerships would emerge.

Strained public finances and escalating national debt, now at record levels, will have far-reaching consequences. This backdrop will see increased demand for private capital to play a role in economic recovery – with figures recently published by Preqin suggesting the total stock of alternates will surpass $17trn by 2025.

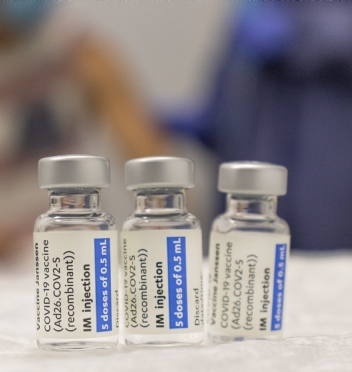

A striking example is the development of Covid vaccines. Governments have extensive responsibilities for health legislation and services, but not for the production of medicines and vaccines, which lie in the Pharma sector, given the vast capital costs involved in developing vaccines and the risks of failure.

Before the pandemic, vaccines could take decades to produce. Still, due to the innovation of companies like Pfizer-BioNTech, they have developed much faster and rapidly deployed around the world in partnership with governments.

In 2022, we can expect to see more examples of private capital put to work in a very new environment, where shortfalls in recovery funding encourage new public-private partnerships.

7. The Demographic Reversal

A global demographic reversal is underway. The working-age population as a proportion of the total is falling pretty much everywhere except in Africa.

Recent research based on UN population statistics by Professor Charles Goodhart and Manoj Pradhan ascribes much of the disinflationary trends of the past 30 years to globalisation and the rise of China.

The global labour supply shock that ensued brought hundreds of millions of new workers into the urban economy, boosting the ratio of workers to dependents in a demographic sweet spot. These forces are dissipating as the world population ages, and global supply chains shorten. China's working-age population will fall 23% by 2050, and the size of the youth population globally will decline in all regions except Africa. The days of moving work to cheaper sources of skilled labour as an alternative to investment and innovation are ending.

Labour will again take a more proactive role in a world short of workers and reassert its position in the triangular relationship with business and capital. Central banks wrestling with inflation will look to increase interest rates. And Finance Ministers will resist in the face of mounting debt servicing and pension costs and under pressure from angry voters.

The outcome will be slower growth and higher inflation, but productivity and social inequality should improve. In terms of investments, returns will not be so easy to come by, accentuating the migration of investment into private capital.

8. The Return of Inflation

A combination of loose monetary policy, supply chain regionalisation, rising post-pandemic demand, and the level of unspent savings accumulated in lockdowns will boost inflation everywhere, especially in the US. Added to this will be the structural reversal of the disinflationary demographic forces that have suppressed prices and labour costs for three decades.

Inflation will spike and then fall back, causing the pandemic driven issues to abate, but the structural change in labour supply will mean that inflation will not return to the super low levels of the last thirty years.

Output growth will see some decline. Moores law is running out of steam, and whilst technology will mitigate some of the worst effects of talent shortages through AI and automation, it will not compensate fully for dementia and the care crisis that is coming.

Governments with social welfare commitments they cannot fund will see public finances under severe pressure and attempt to raise taxes to compensate. History tells us that with taxation levels (such as in the UK) already at 70-year highs, populism will push back hard, leaving governments to raise even more debt.

9. Tech Wars

We predicted that: Technology would remain front and centre in 2021, but there would be a new spotlight on national security issues. We also forecast the evolving approach to state aid and the likelihood of anti-trust lawsuits in the US and EU.

It seems everyone has it in for the tech groups despite most of us using their ubiquitous smartphones for almost every waking hour of our lives. In 2021 a regulatory crackdown saw US and Chinese tech groups subjected to increased scrutiny. In 2022 we expect more of the same. Tech groups have become politically influential powerhouses, and in a digitally reliant world, they will see increased government and regulatory attention.

10. Climate Change

Extreme weather events increased in frequency and severity in 2021. The sixth edition of the intergovernmental climate report insisted the evidence for human-induced warming was "unequivocal", and its impact felt across the globe.

UN secretary-general António Guterres described the contents of the report as "a code red for humanity. As discussed in our previous Global Perpectives Blog, in 2022 climate activists everywhere will hold the COP26 participants to account, pointing to a historical litany of failed commitments and broken promises.

The activist community will challenge the corporate world to disclose net-zero targets and the pathway to delivering on their climate promises. Commentators will closely monitor a rare pledge by the US and China to collaborate on climate change initiatives.

Implications for IFCs

There will be headwinds in 2022. Deficit nations with strained public finances tend to protectionism under pressure. Global tax rule implementation, changes to FATF requirements around beneficial ownership rules, new EU regulation, Net Zero commitments, resurgent inflation, and a world increasingly built around regional power blocs will combine to increase the cost and complexity of doing cross-border business.

BUT, the good news is worldwide household wealth has increased enormously over the last two decades. Despite the Great Financial Crisis of 2009 and the current pandemic, household wealth was estimated by Credit Suisse to be $418trn at the end of 2021 and expected to grow by almost 40% by 2025.

The consequence of the enormous burdens and constraints on public finances is that governments will look to private sector investment and solutions to many of the challenges facing citizens worldwide - good news for the centres that advise, manage and administer these investment flows.

We hope you have found the subject matter in this post to be of interest and will seek to unpack some of these subjects in more detail as we go through 2022, beginning with the outlook for Private Capital in January.

About our Blog

Global Perspectives provides regular, on-point commentary on relevant topics in a pithy and accessible way. Our observations and points of view are based on listening hard to clients global needs, priorities and concerns. We draw on insights from every area of our business and collaborate to deliver this global thinking; something that clients tell us is distinctive and sets us apart. If you'd like to find out more, please get in touch.

About Mourant

Mourant is a law firm-led, professional services business with over 60 years' experience in the financial services sector. We advise on the laws of the British Virgin Islands, the Cayman Islands, Guernsey, Jersey and Luxembourg and provide specialist entity management, governance, regulatory and consulting services.

.jpg)